Tom Lee – Upcoming Rebound

以下是ai笔记,请前往原视频观看。

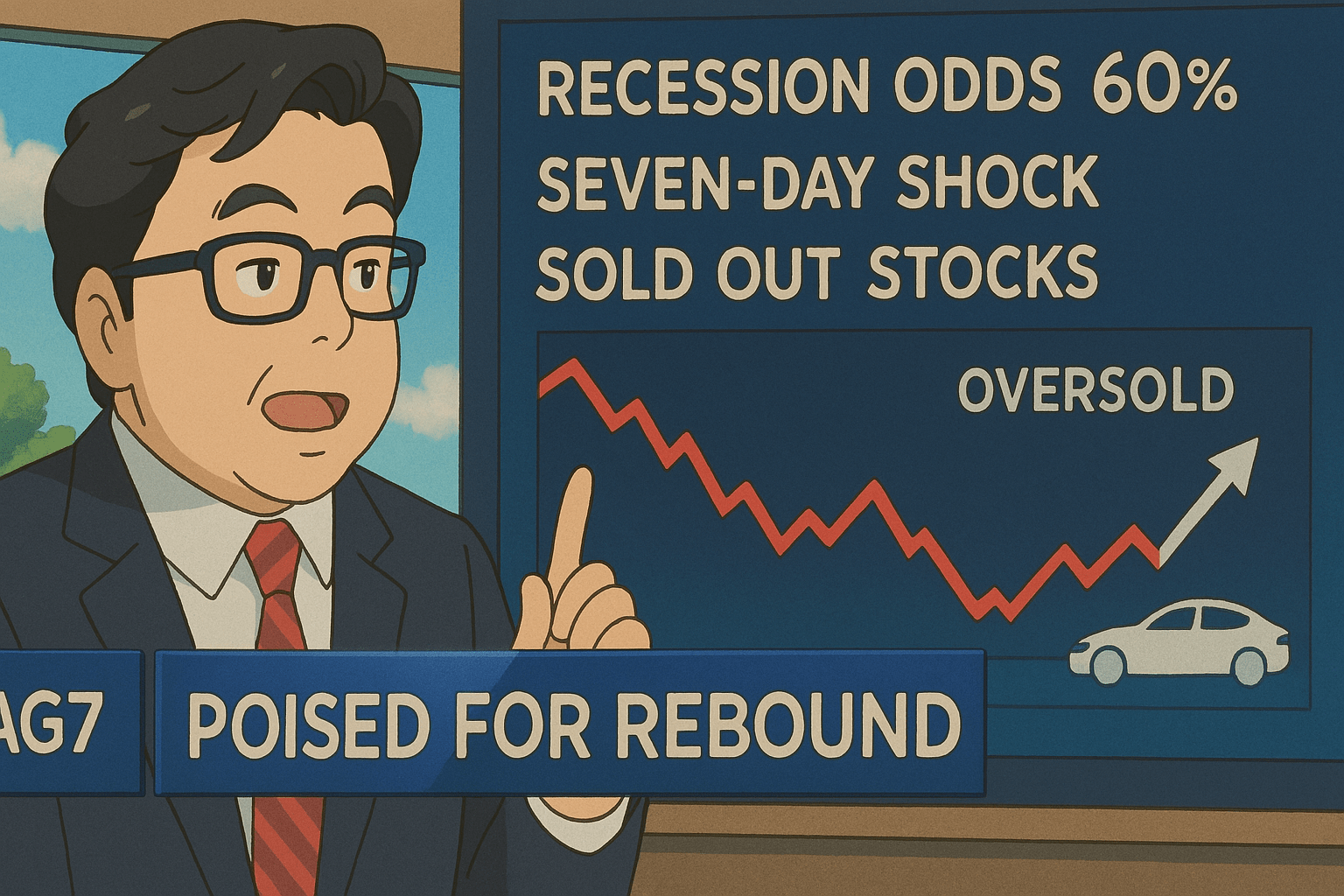

Summary of Tom Lee Interview on CNBC

Tom Lee believes the market’s pessimism surrounding a potential recession is overblown. While acknowledging the significant volatility and the “draconian” impact of tariffs, Lee argues that the U.S. economy is resilient and that stocks are “hugely oversold.” He suggests the market is reacting to a situation that could de-escalate quickly if the U.S. and China simply “blinker” on tariff negotiations. Lee advocates for a buyer’s strategy, particularly focusing on “sold out stocks” – stocks that have already priced in the worst news. He specifically highlighted the “MAG7,” including Tesla, as a group poised for a rebound. Lee’s outlook is heavily reliant on the potential for a “White House policy put,” indicating a belief that the administration will take action to mitigate economic damage, rather than a prolonged period of trade conflict.

Key Statistics:

- 60% Probability of Recession: The market is pricing in a 60% probability of a recession.

- Seven-Day Shock: The recent market volatility represents a “shock” of only seven days in amplitude.

- Sold Out Stocks: Lee recommends focusing on “sold out stocks,” which have already seen the worst news priced in.

- MAG7: He specifically names Tesla as part of the “MAG7” group expected to rebound.